One day, the term ‘hard cash’, and other financial instruments will soon be obsolete, thanks to the aggressive growth in cryptocurrency and its flexibility with regard to transactions. Though it comes with a downside of falling into the wrong hands, causing a financial disaster in larger proportions, its popularity cannot be denied.

As far as research in the field is concerned, the study of cryptocurrency has been shied away, largely because it is unregulated and no single government body has direct control over it. On the other hand, artificial intelligence and machine learning enthusiasts are beginning to explore trading cryptocurrencies using techniques such as Reinforcement Learning (RL), meta-learning among many others, to make it easier for research purposes as well as making it beneficial for the betterment of society.

Artificial Intelligence for Cryptocurrency Predictions

Cryptocurrency platforms will soon reap the benefits offered by artificial intelligence(AI) and machine learning(ML). The year 2017 saw the rise of cryptocurrencies in magnanimous amounts. In the near future, it will be the norm of monetary payments if regulated legitimately. For example, Coinbase, the popular exchange platform has come up with an added security functionality to verify users’ identities as well as monitor market predictions.

Another instance of AI presence in trading cryptocurrencies is by VantagePoint, an AI-assisted forecasting software used to predict market prices (low and high) of cryptocurrencies along with additional information such as equities and commodities. A typical analysis involves highlighting the top popular markets in cryptocurrencies which is then fed into the company’s proprietary software. The software implements a non-linear ‘weight matrix’ to generate forecasts to match the target market cited by the user.

Lane Mendelsohn, Vice President of VantagePoint Software emphasizes that AI is the key to attract more trading opportunities among traders and investors through cryptocurrencies. This seems lucrative but comes with downsides, such as computing limitations (hardware and processing power), trust among the public, and limited data available in cryptocurrencies unlike the traditional stock market which has vast amounts of tangible data. Therefore, given the time and effort, it is certain that AI will overcome these setbacks and completely predict the digital market.

The companies listed above have shown keen interest in incorporating AI agents in some or the other form. “Intelligent Agents” as they are called, handle the complexity of tasks or the level of intelligence required for the task. It all depends on how rational the intelligent systems should be when it comes to predicting data. Be it performance, perception of trading environment or previous trading knowledge.

The tactics of using Reinforcement Learning on a research perspective

Reinforcement Learning(RL), which is a facet of ML and AI can be used to predict cryptocurrency markets. Since there is limited work available for research purposes, we can use the concept of RL to optimise and predict these volatile markets.

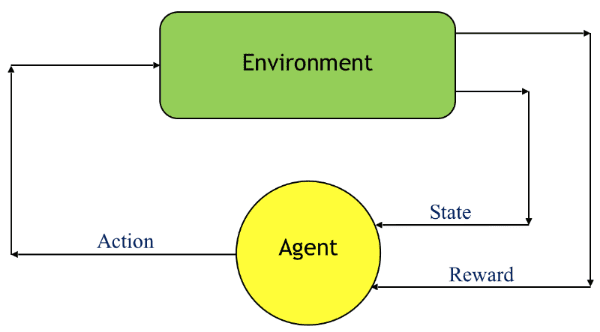

RL takes the form of a Markov Decision Process(MDP) tree since there are many factors at play in trading. MDP is adopted because the trading environment is highly variable and volatile. It is chosen to work with the current state (in this case, trading market) rather than working with past data to optimise a decision.The decision system is given below:

- Agent : The agent for this scenario is the trading agent — For example, Unocoin, an Indian cryptocurrency exchange platform employees trading agents who make decisions based on the live market.

- Environment : One could say that the environment is the exchange platform itself. But, on hindsight, the exchange has human as well as algorithmic agents acting in the environment. At this stage, it is assumed that we only consider a single environment to eliminate complexity.

- State : The current state of the market is only considered. This again forms a Partially Observable Markov Decision Process (POMDP), which means the agent observes only a part of the actual state of the environment.

- Action: In RL, there is a contrast between discrete and continuous variables. It depends on how far the user is willing to take up complexity in terms of algorithmic factors. Usually, in this scenario, we consider “buy” and “sell” as two action spaces.

- Reward : The possibilities for choosing a reward function are numerous. The user can concentrate on the profit margin to obtain positive feedbacks than negative feedbacks fed to the system.

Now that we have a framework as to what goes into learning, we list down the key techniques that a user can utilise to enforce proper reinforcement algorithm.

- End-to-end optimisation: RL optimises the reward function, which is specified by the user. For example, profit/loss trend can be combined to the reward function to optimise larger monetary gain.

- Policy-learning: Instead of coding a rule-based policy, RL can learn the policy itself to improvise over time with respect to the model. A good example is the inclusion of a deep neural network.

- Flexibility to model other agents: RL can also be extended to other agents, if incorporated, in the project. For example, the market trend can also be observed along with price details.

This is just a handful of techniques in an ocean of learning algorithms. Also, the numerical computations is not covered in this article. The theme of the article here is to how AI and RL can prove to be beneficial when it comes to finance in the digital space. Ultimately, cryptocurrency trading is a vast phenomenon and people might be baffled with the market fluctuations happening in real-time. It is recommended that they master the basics to get a solid grip of the cryptocurrency arena.