With 20+ years of experience in market research, retail banking, strategic analytics and planning, Vijay Kumar has had a strong hold in IT project design, execution and management. Specializing in business strategy and planning, customer segmentation, data mining & warehousing, application design and much more, he has led the analytics department of SBI, leading public sector bank, headquartered in Mumbai.

Analytics India Magazine interacted with Vijay Kumar, who believes that the recent merger of SBI with its five associate banks sets an excellent example of how data was used to bring a seamless transformational change. Read further on his views about analytics defining state of banking in India, introduction of technology such as chatbots in banking, challenges in the space and much more.

Analytics India Magazine- How is analytics redefining the state of banking in India? How has State bank of India adopted advanced analytics and what are the tools at disposal?

Vijay Kumar- While competition grows more intense with new banks coming into existence, and global economic growth remaining modest, a constantly evolving regulatory environment presents its own set of challenges. In addition to that, fraud and cyber security threats have become an increasing menace. Faced by this perfect storm, banks are under tremendous pressure to improve operating efficiencies and grow wallet share to sustain profit margins. In this scenario, Analytics is helping deliver better operating ratios through both top-line and bottom-line initiatives, drive customer engagement, mitigate risks, and optimize the utilization and deployment of banks’ resources.

State Bank of India has a fully functional data warehouse paired with both a robust BI platform, and highly skilled statisticians – this has enabled the delivery of Analytical insights for use at every level in the organization for several years now.

AIM- Would you like to highlight a few use cases on how data, analytics and related technologies are being used at SBI?

VK- The recent merger of SBI with its five associate banks and BMB was an excellent example of how data and information have been used to bring about transformational changes in the bank seamlessly. From branch network optimization to risk management, and from human resource planning to technology integration, from currency chest operations to treasury – all aspects of the merger were driven by data based decision making. Even the minutest things such as process and business audit closures and training were planned meticulously, which is a large part of the reason why the merger went off so well, with minimal service disruptions.

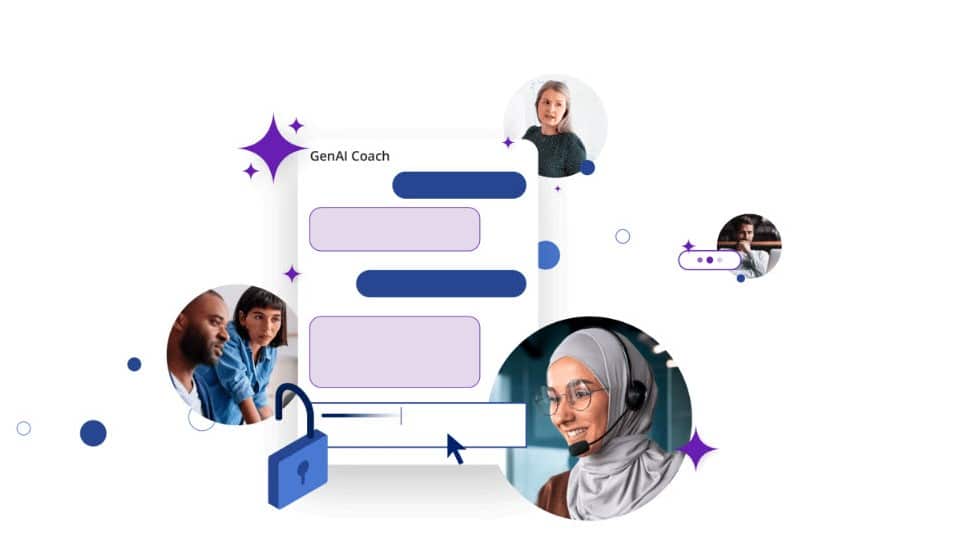

AIM- With chatbots becoming a trend in consumer facing industries such as banks, has SBI come up with similar similar technology? What similar technology it plans to come with?

VK- SBI has a large and diverse workforce of over 250,000. SBI has successfully deployed workforce enablement tools like chat-bots which have helped improve productivity and quality of customer service personnel. A number of self-service tools such as SMS banking and mobile apps have been made available to customers, and are used by millions of customers. SBI’s current customer service platform supports several different languages. However, the technology that powers chatbots is primarily in English, and has rudimentary support for other languages, especially Indian languages. It will take some more time for these to evolve to a level where these can be offered to such a diverse customer base.

AIM- How are you creating actionable insights from the customer data at SBI?

VK- SBI has a rich Data Warehouse which is at a T+1 refresh state. A unique customer identification algorithm is at the heart of customer insights abilities which is now being supplemented by a house holding algorithm which will collate all customer-customer relationships, both declared and undeclared. The Data Warehouse not only gives information about the accounts a customer holds, but also of all his/her interactions with the bank. The data warehouse also includes data on the customer’s relationship across the larger State Bank group of companies. This data is used to develop Analytical models that predict the customers’ behavior and needs and help tailor the bank’s product offerings to best suit individual customers.

A sophisticated CRM system that will enable the delivery of these insights to various customer touch points – whether it be branch banking or phone banking, the internet or mobile banking – has recently gone live at SBI.

AIM- What are the various scenarios where analytics has helped SBI? How has been the growth of analytics adoption at SBI?

VK- SBI has a large and diverse portfolio of products servicing a wide spectrum of customer segments. SBI has grown significantly and rapidly over the past few years. The branch network has doubled over the last twenty years, and the total business has grown almost twenty fold over the same period. The bank has maintained profitable operations throughout this period, while actively mitigating risks. Such explosive growth would not be possible to manage efficiently without effective use of Data-driven management practices at SBI. Be it Treasury operations, or branch operations, Foreign-exchange dealing, or Credit Risk, development of Alternative channels or cross-sell, Rural Banking or Corporate Credit – Analytics plays a part in improving the bank’s performance on multiple metrics.

AIM- Would you like to highlight any analytics solution that you have very recently worked upon at SBI?

VK- There was a recent project involving Natural Language Processing, Artificial Intelligence and Text analytics. Given SBI’s large workforce and the fast-changing regulatory environment, it is very critical, but difficult to keep the entire workforce up to date on all the recent policy guidelines – both external and internal. The solution devised had a very simple question-and-answer interface, with a very sophisticated system underlying it involving NLP for understanding the question, a Cloud-hosted, Big Data repository to hold all the policy documents, including historical notes, and a core Text Analytics algorithm which parsed multiple documents and produced a synthesized answer for the question (and not just a vanilla list of linked documents).

AIM- What is your roadmap/plans for analytics at SBI in the future?

VK- SBI is in the process of implementing a Big-Data infrastructure that will significantly enhance data storage capacity, while improving the speed at which this data can be processed to generate actionable insights. At the same time, a CRM solution is being developed which will deliver these insights to various customer interaction touch points.

A related initiative is redefining the Business Intelligence delivery capabilities in the bank, leveraging the new infrastructure, and presenting information in an intuitive, visual format, delivered on handheld devices with deep drill-down capabilities. This will provide both line and senior management the tools which will enable them to quickly assess the performance of the bank on various parameters and deep dive into potential problem areas.

At the same time, the modeling capabilities across business lines in the bank are continuously evolving, while data quality assurance and governance efforts are being stepped up.

AIM- What are the most significant challenges you have faced being at the forefront in analytics space in the banking industry?

VK- From an inputs perspective, the biggest challenge continues to be the low availability of high-quality, up-to-date and well-integrated data. Banks across the country are still developing the technology and processes to ensure data is integrated across all lines of business and service channels, and updated regularly. Scattered, missing and erroneous data presents its own unique governance challenge. From a dissemination perspective, not being able to present the insights in a timely fashion at the point where it is consumed is the greatest hindrance. Once the twin challenges of generating high-quality insights and effectively delivering these insights have been resolved, the acceptance and adoption of Analytics will automatically improve, especially when there is sponsorship of Analytics initiatives at the highest levels of the organization.